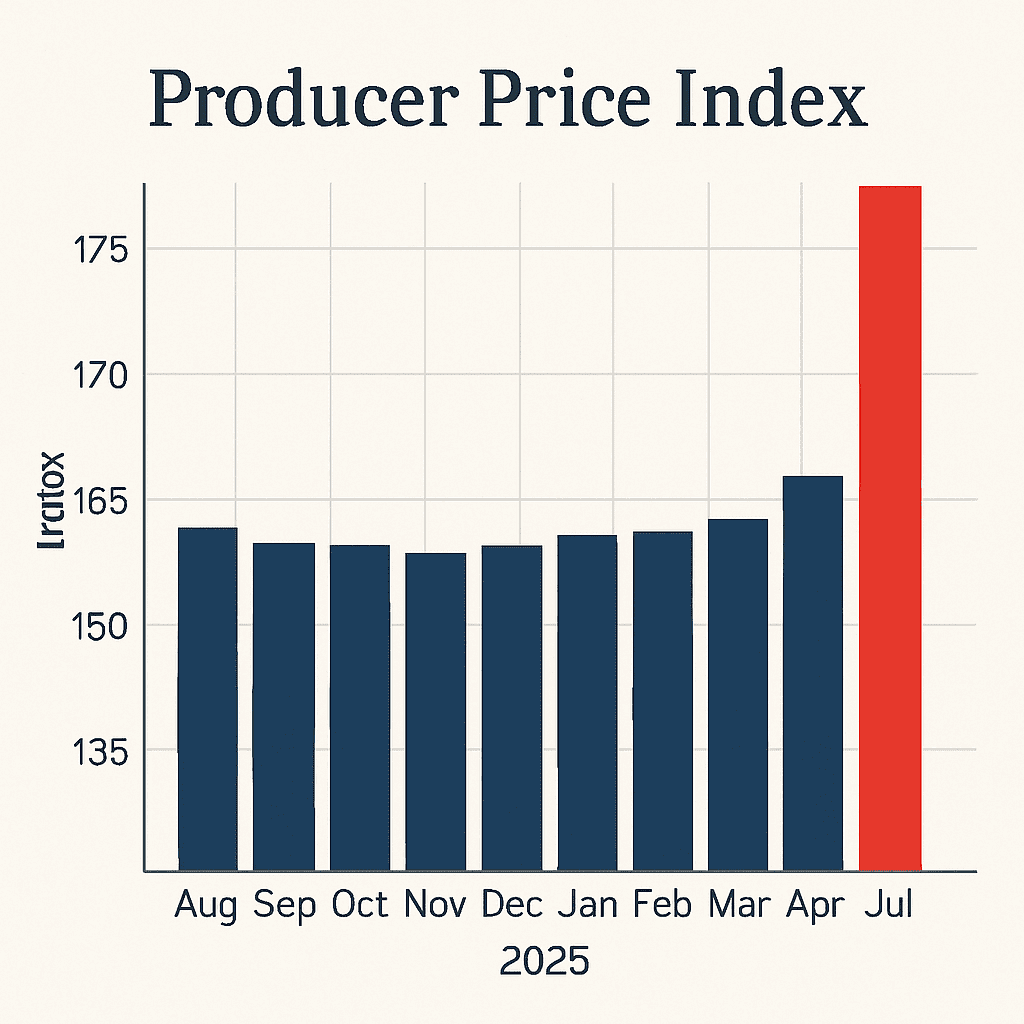

Markets Falter as Producer Prices Jump 0.7% in July

A sharp rise in the U.S. Producer Price Index (PPI) has rattled markets—producer prices climbed 0.7% in July, marking the sharpest increase in three years. The surge was most pronounced in the services sector, contributing to volatile stock reactions across the board.

This unexpected inflation pressure comes at a sensitive moment, with the Federal Reserve closely monitoring inflation data for monetary policy decisions.

Services Lead the Charge in Wholesale Inflation

Core PPI—excluding volatile food and energy—was up 0.4%, suggesting broad inflationary trends. Notably, services such as warehousing, logistics, and insurance were among the highest contributors, due in part to rising input costs and tight labor markets.

This follows recent data showing that wholesale inflation has become increasingly sticky, especially as supply chains rebalance post-pandemic.

Stock Market Reacts with Caution

Despite a tentative opening, U.S. equity markets gave back earlier gains as investors digested the PPI data. Both the Dow fell and S&P 500 dropped, while the Nasdaq ended mixed—reflecting investor concern that elevated inflation might delay any pause in Fed policy tightening.

Markets are also eyeing upcoming retail and consumer inflation numbers for additional confirmation.

What This Means for Consumers and the Fed

The PPI spike suggests pressure may soon trickle down to consumers via higher retail prices—warning signs for core CPI ahead. Economists warn food, housing, and transport could absorb some of the inflation burden.

For the Fed, this is likely to reinforce current hawkish leanings. There’s growing sentiment that rate cuts won’t happen until inflation stabilizes more convincingly—perhaps not until late this year.

Key Takeaways

| Key Insight | Detail |

|---|---|

| July PPI Increase | 0.7%—largest gain since 2022 |

| Core PPI | Up 0.4%, signaling broad-based inflation |

| Services Inflation | Highest contributor—warehousing, insurance, logistics |

| Market Reaction | Dow and S&P 500 dipped, Nasdaq mixed |

| Fed Implications | Higher chance of delayed policy easing amid sticky inflation |

| Consumer Risk | Inflation may soon hit retail prices across key sectors |

Stay connected with TrendScoop360 for more updates on this story and other trending news across the United States and the world.